36 HQ Images Credit Score Apple Card - How does the Apple Card work exactly? - Techilife. Apple card offers an apr between 13.24% and 24.24% based on your credit score, and all approved cardholders will be placed at the bottom of the interest tier they fall into, which will save everyone a little bit of interest. To rate credit cards we objectively assess, score and weight nearly 100 individual card features which. Apple card is built directly into the wallet app on iphone, and the application process is seamless. Apple points out that this is the first consumer credit card that goldman sachs has issued. It's secure and you can always see at a glance what you've spent and where.

ads/bitcoin1.txt

All eyes are on the apple card, but is it the best credit card choice for you? And issued by goldman sachs, designed primarily to be used with apple pay on apple devices such as an iphone, ipad, apple watch, or mac. The bank behind the card, goldman sachs, has been approving users for the card who have subprime credit scores at the direction of apple, cnbc reported. Apple card offers an apr between 13.24% and 24.24% based on your credit score, and all approved cardholders will be placed at the bottom of the interest tier they fall into, which will save everyone a little bit of interest. That's a wider range than most cards have, creditcards.com industry analyst ted rossman said.

Apple card is a credit card created by apple inc.

ads/bitcoin2.txt

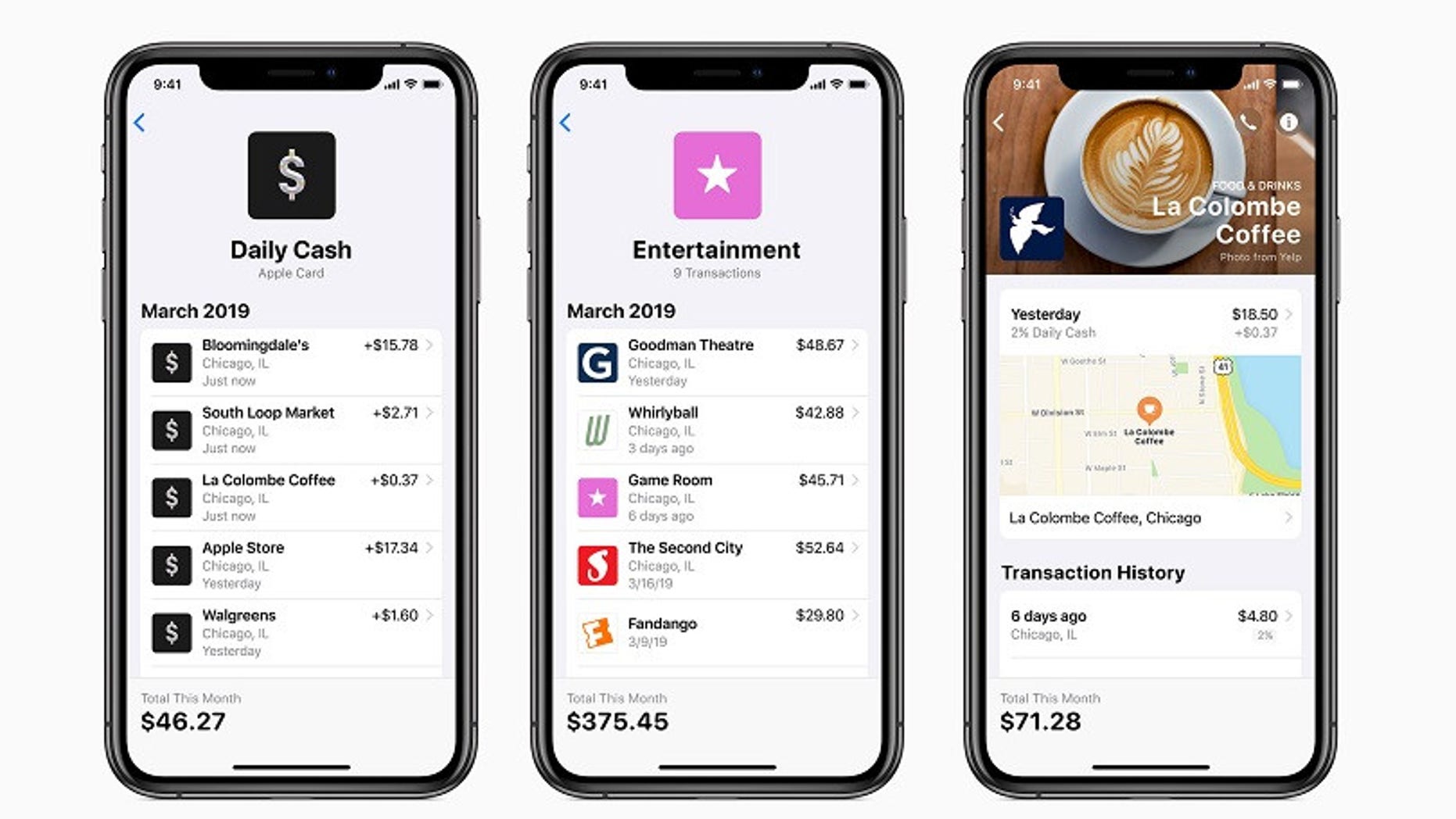

Goldman sachs has not had a sound reputation for. Apple has announced its first credit card, the apple card, to be used with apple pay. Apple's credit card easily integrates with apple pay, though this benefit is marred by a low rewards rate apple credit card's outstanding benefits. Apple, cash back credit card, goldman sachs, metal card, no annual fee, no foreign transaction fee. For example, the card offers the ability to make more frequent payments and suggests paying more each month to help cardholders pay less in interest. The new apple credit card is issued by goldman sachs and will run on the mastercard network. On a positive note, you can ask for help and receive support via text, though it's unclear if this service is available 24/7. I talk about credit scores, my card's credit limit, how to apply for the card, hot to pay it off, how fast is the application and setup, why it doesn't work at costco, etc. The apple card now affects your credit score with all three major us credit rating agencies: This is an attempt to challenge the current credit card market by apple. After the soft inquiry, you will know if you're likely to be approved for the apple card's interest rate can go up to 23.74%. It's secure and you can always see at a glance what you've spent and where. People need to understand what their credit score is, schulz said.

This means that some applicants with fair. Applicants are prompted to input basic information including credit score requirements. The apple card's interest rate can go up to 23.74%. It's secure and you can always see at a glance what you've spent and where. Your apple card application begins with a soft inquiry, which doesn't affect your credit score.

3% cash back on apple purchases and services.

ads/bitcoin2.txt

This means that some applicants with fair. Like other credit cards, the apple card has a high interest rate for people who carry a balance. Sources told cnbc that apple asked goldman. I talk about credit scores, my card's credit limit, how to apply for the card, hot to pay it off, how fast is the application and setup, why it doesn't work at costco, etc. Apple card, apple's new credit card, applications are now available for iphone users. This article highlights a number of factors that goldman sachs uses, in combination, to make credit decisions but doesn't include all of the details. Apple, cash back credit card, goldman sachs, metal card, no annual fee, no foreign transaction fee. Apple card is a credit card designed to support your financial health through smarter tools, easier interest payments, and greater transparency. And issued by goldman sachs, designed primarily to be used with apple pay on apple devices such as an iphone, ipad, apple watch, or mac. Goldman sachs1 uses your credit score, your credit report, and the income you report on your application when reviewing your apple card application. This is an attempt to challenge the current credit card market by apple. For example, the card offers the ability to make more frequent payments and suggests paying more each month to help cardholders pay less in interest. The bank behind the card, goldman sachs, has been approving users for the card who have subprime credit scores at the direction of apple, cnbc reported.

This article highlights a number of factors that goldman sachs uses, in combination, to make credit decisions but doesn't include all of the details. It's secure and you can always see at a glance what you've spent and where. Here's how to tell if there's a spot for it in your digital wallet. Apple card is goldman sachs' first credit card, so this is unknown territory, and the customer experience remains to be seen. Apple card offers an apr between 13.24% and 24.24% based on your credit score, and all approved cardholders will be placed at the bottom of the interest tier they fall into, which will save everyone a little bit of interest.

Apple's credit card easily integrates with apple pay, though this benefit is marred by a low rewards rate apple credit card's outstanding benefits.

ads/bitcoin2.txt

That's a wider range than most cards have, creditcards.com industry analyst ted rossman said. Apple card offers an apr between 13.24% and 24.24% based on your credit score, and all approved cardholders will be placed at the bottom of the interest tier they fall into, which will save everyone a little bit of interest. On a positive note, you can ask for help and receive support via text, though it's unclear if this service is available 24/7. Goldman sachs1 uses your credit score, your credit report, and the income you report on your application when reviewing your apple card application. That's why when we created apple card, we took every. Card will earn the following rewards: All eyes are on the apple card, but is it the best credit card choice for you? A credit score speaks to your creditworthiness, which is important to apple. What's your approved apple card credit limit? Here's apple's list of requirements: And issued by goldman sachs, designed primarily to be used with apple pay on apple devices such as an iphone, ipad, apple watch, or mac. Applicants are prompted to input basic information including credit score requirements. Is apple card the best credit card in 2019?

ads/bitcoin3.txt

ads/bitcoin4.txt

ads/bitcoin5.txt